Organization

City Government of General Santos

Best Practice Focus Area/s

Leadership, Human Resource

Year Implemented

February 2018- Present

This is a Recognized Best Practice

Summary

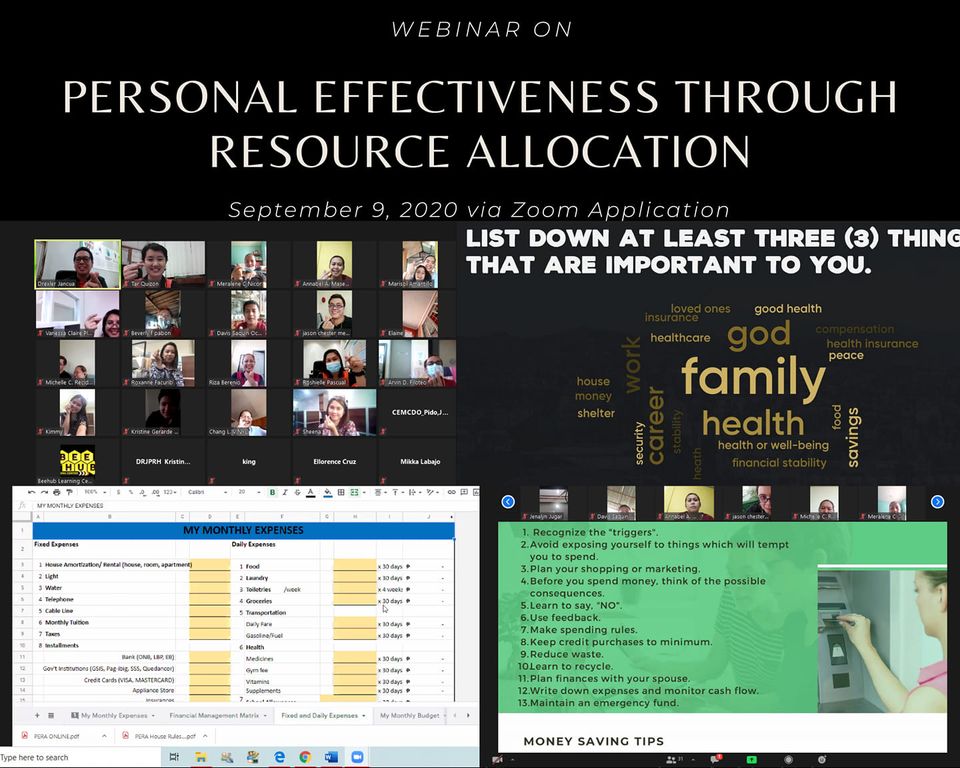

High-Personal Effectiveness Through Resource Allocation or HI-PERA is an unconventional initiative for the development and sustainability of sound financial management among the regular employees of the City Government of General Santos (LGU-Gensan). From the first quarter of 2018 to the present, the Human Resource Management & Development Office (HRMDO) has pioneered the radical move to revive, re-strengthen and innovate the ways to aid in the enduring problem of uncontrolled and deteriorating credit behavior of the employees in the city government.

Background and Problem

In 2017, verified reports showed that many employees were seriously charged with complaints from money lending institutions and private individuals due to uncontrolled and deteriorating credit behavior. Employees have reportedly surrendered their payroll ATM as loan collateral, thus draining the proceeds of their salaries, bonuses, and incentives. Subsequently, this has caused habitual absences, underperformance, and a low level of productivity that affected their performance in particular and the city government as a whole.

One of the mechanisms employed by loaning agencies and private lending individuals to ensure the collection of payments is to require creditors to deposit their payroll ATM from where their regular payments will be directly withdrawn. This places the employees at the mercy of these lenders and stops them from accessing their salaries. When policies prohibit employees from applying for loans resulting in net take-home pay lower than Php 5,000.00, employees can still circumvent ways to apply for loans from private lending individuals who require the same collateral deposit. Furthermore, these loan sharks reportedly collect more than the required payment putting their other monetary benefits at risk, such as mid-year & year-end bonuses, CNA incentives, and other allowances.

Consequently, poor work performance was evident in the observable and habitual absences of the concerned employees on the salary days allegedly because of purposeful evasion from loan sharks who personally visit offices to collect due and unsettled payments. These circumstances have led local leaders to legislate policies to mitigate the growing number of employees at risk of not rising to financial stability due to undesirable credit behavior. While the employees can be blamed for availing these types of loans, the HRMDO needs to devise an intervention to prevent this deplorable practice.

Solution and Impact

Founded on the philosophy that an employee’s financial wellness directly affects work productivity and job performance, Hi-PERA implements a strategy that deals with the employee’s lack of sound financial management skills by operating with a certain degree of discipline with a compassionate end in mind to implement policies and interventions helping employees to get through their financial struggles. As such, Hi-PERA is designed to implement mechanisms that will help develop and sustain sound financial management skills of the regular employees through interventions such as one payroll ATM-ID system and one-bank-loan policy; consistent financial literacy programs; sustainable savings facilities; and reliable income expansion programs.

With the aid of local legislation, the initial approach of Hi-PERA is implementing an integrated ID-ATM system that combines biometrics scanning through facial recognition and ID-ATM confirmation. The administration has also called for prompt implementation of establishing an exclusive partnership with a reputable banking institution under the One-Bank Policy, granting salary loans to city government employees with longer terms of payments and lower interest rates. This is complemented by the efforts of HRMDO to sustain the consistent conduct of capacity-building activities on financial management skills, the introduction of accessible and reliable savings facilities offered by banks, cooperatives, and other financial institutions, and the initiation of income expansion or livelihood literacy programs.

The practice has brought a quantum leap in the financial status of the affected employees that has a direct positive effect on their work performance, as demonstrated by the curve of improvement in their Individual Personal Commitment Ratings (IPCRs) since the onset of Hi-PERA implementation up to the present. This is proven true by the recent study and analytics of the figures that make up the opposite trend in the decreasing number of employees with a net salary lower than Php 5,000.00 and the increasing mean of their IPCR ratings.

HI-PERA has consistently ignited interest from other benchmarking government agencies who have explicitly expressed appreciation and intent to adopt the same practice in their respective workplaces. Ultimately, the program is significantly valued in the level of personal development of employees and the organizational development of the city government, as proven by the local and national recognitions.

Milestones/Next Steps

Data shows that Hi-PERA significantly reduced the number of employees whose net take-home pay is equal to or lower than Php 5,000.00 since the onset of the program implementation. This positively projects that the program continues to realize its aim to implement mechanisms to develop and sustain the sound financial management skills of the regular employees.

Furthermore, the recent study and focus group discussion (FGD) with the purposely selected employees for the first and second quarters of 2020 revealed that the HI-PERA positively affected employees. Validated reports also disclosed that their financial status is simply improving, with some who could pay off all their debts and others who have been diligently propelling their business ventures for expanded income sources.

As a significant achievement, this innovation has attributions to the notable distinctions conferred to HRMDO and LGU-Gensan in the nationwide search for People Management Association of the Philippines (PMAP) organization in 2019 wherein the HRMDO Department Head, Ms. Leah Y. Tolimao, was awarded as the “People Manager of the Year Award,†while LGU-Gensan was conferred the “The Employer of the Year†award. The Civil Service Commission also granted the organization the PRIME-HRM Level II status because of the best governance and administration practices, including Hi-PERA.

It is also remarkable that several government agencies, primarily LGUs, consistently conduct benchmarking activities in HRMDO and LGU-Gensan. This observation has led them to explicitly express the aim to adopt the same in their respective agencies. As per the consensus gathered from them, HI-PERA is proven to be an effective practice in financial management for the personal development of employees and the organizational development of the agency.