Overview

The Cagayan de Oro City Government consistently introduces remarkable programs aimed at maximizing the city’s revenue. One such innovation is the Cagayan de Oro Mapping Online Application (MOA), a tool developed by the City Treasurer’s Office to improve tax mapping and revenue generation in the city.

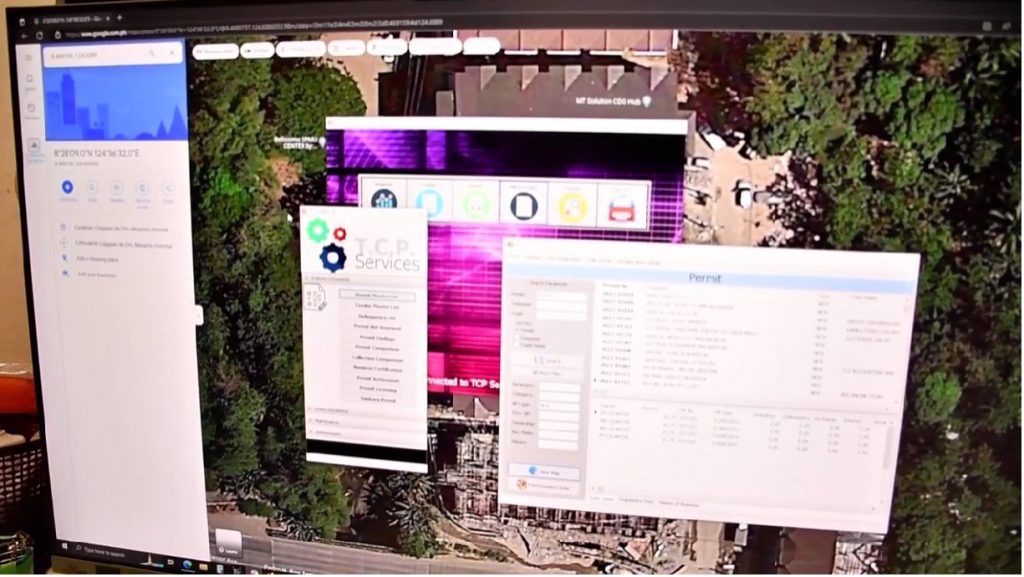

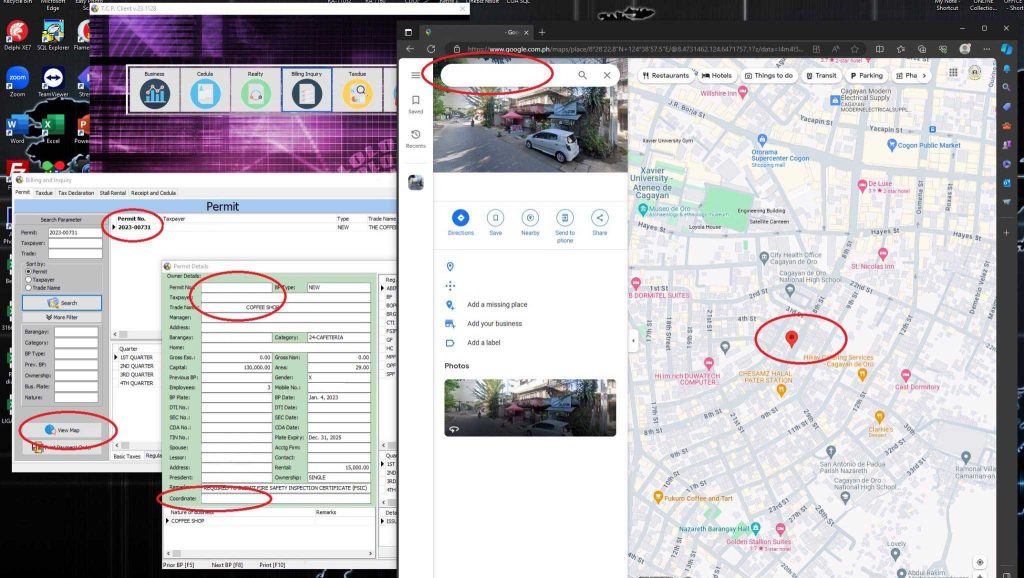

The MOA offers a digital solution by seamlessly integrating traditional documents, facilitating convenient access to information, and establishing a paperless workflow. Furthermore, the MOA incorporates a GPS tagging system, integrated with Google Maps, ensuring nearly precise locations for tax mappers, thereby streamlining the verification process for business permits.

The MOA aims for real-time tracking of tax records and efficient tax mapping. Prior to its implementation, the tax mapping team encountered a cumbersome process of handling physical documents in the field. The MOA has significantly improved efficiency, transparency, and revenue collection for the city.

Challenge

The Cagayan de Oro MOA alleviates the cumbersome process of tax mapping and revenue generation faced by the tax mapping team. Prior to the implementation of the MOA, the tax mapping team encountered challenges related to handling bundles of physical documents such as tax due worksheets, official receipts, and copies of business permits. These documents hindered their mobility and created inefficiencies in their fieldwork tasks.

Solution

The Cagayan de Oro MOA provides innovative solutions to address the tax mapping and revenue generation challenges of the city. Some of its innovative features include:

Digital Integration of Documents: The MOA digitally integrates the traditional documents used in tax mapping, such as tax due worksheets, official receipts, and business permits. This eliminates the need for physical documents, reducing paperwork and enabling tax mappers to access necessary information easily, even in the field. The digital integration of documents makes the process more efficient, convenient, and environmentally friendly.

GPS Tagging and Google Maps Integration: The MOA incorporates a GPS tagging system linked to Google Maps, providing tax mappers with near-accurate locations of business establishments. This feature allows tax mappers to verify the authenticity of business permits, ensuring compliance and transparency. The integration with Google Maps enhances the accuracy and efficiency of tax mapping, enabling tax mappers to navigate and locate establishments more effectively.

Paperless and Mobile Solution: The MOA is a browser-based application issued to tax mappers that is accessible through tablets. This paperless and mobile solution allows tax mappers to carry the application during fieldwork, eliminating the need for physical paperwork and providing real-time access to information. The mobility and convenience of the MOA significantly improve the productivity and effectiveness of tax mappers.

Productivity Gains, Outcomes, and Impact

The Cagayan de Oro MOA has demonstrated measurable productivity gains and outcomes that have positively impacted the City Government of Cagayan de Oro and taxpayers alike. By streamlining the tax mapping process and enhancing revenue generation, the MOA has brought about several notable improvements.

The innovative features of the MOA contribute to the overall efficiency and effectiveness of tax mapping in Cagayan de Oro. The digital integration of documents and GPS tagging systems streamline the process, reduce errors, and promote transparency. The paperless and mobile nature of the application enhances productivity, allowing tax mappers to perform their tasks more efficiently in the field. The MOA’s innovative features provide a modern, user-friendly, and technology-driven solution to the challenges faced by the tax mapping team, making it a valuable tool for revenue generation and decision-making in the local government.

In terms of measurable outcomes, the MOA has positively impacted revenue generation for the City Government. Prior to the full implementation of the MOA in 2018, there were approximately 20% of registered business establishments that were not properly tax-mapped. However, with the MOA’s implementation, there has been a significant increase in business tax revenue collection. According to statistics, there was a 3% increase in the registration of business permits, amounting to approximately Php 1.573 Billion in total collection as of July 31, 2019.

The intervention provided by the MOA has improved the productivity performance of the City Government of Cagayan de Oro by enabling more efficient tax mapping operations. The digital integration of documents and the utilization of GPS tagging have streamlined processes, reduced manual work, and enhanced data accuracy. This has enabled tax mappers to carry out their tasks more effectively, leading to improved revenue collection and data-driven decision-making for the City Government.

Lessons Learned/Challenges in Implementing the Intervention

The implementation of the MOA brought about valuable lessons and highlighted potential areas for improvement. One key lesson learned was the importance of comprehensive user training and support. It became evident that providing tax mappers with thorough training on the application’s features and functionality was crucial for their successful adoption and effective utilization of the MOA. Ongoing support and guidance were also necessary to address any issues or questions that arose during their use of the application.

Engr. Leonil G. Mistula, the Assistant City Treasurer for Operations, underscored the advantages of embracing the MOA. According to him, the tool facilitates real-time tracking of businesses, establishing an efficient system that benefits taxpayers and contributes to revenue growth.

Another lesson was establishing a continuous feedback loop with the tax mappers. Regularly seeking their input and suggestions allowed for improvements to the MOA based on their real-world experiences. This feedback mechanism proved invaluable in enhancing the usability and functionality of the application, ensuring that it aligned with the needs and preferences of the end-users.

Technical maintenance and updates were identified as another important area of focus. Regular upkeep and updates were necessary to address any technical issues, ensure compatibility with new devices and operating systems, and incorporate new features that would enhance the overall performance and efficiency of the MOA.

Additionally, optimizing the user experience was recognized as a crucial aspect. Regular evaluations of the user interface, workflow processes, and overall user experience helped identify areas where the MOA could be streamlined and improved. By addressing usability issues and making the application more intuitive and user-friendly, tax mappers’ productivity and satisfaction levels could be further enhanced.

Looking ahead, potential areas of improvement for the MOA included increasing data accuracy and completeness. Efforts to further integrate the MOA with other relevant systems for seamless data sharing and analysis were also identified as a potential avenue for improvement. Exploring advanced technologies like artificial intelligence and machine learning for enhanced decision-making and data management was also an area of interest.

By addressing these lessons learned and areas for improvement, the MOA could continue to evolve and effectively serve the needs of the tax mapping team, promoting efficiency and transparency in revenue generation for the Cagayan de Oro City Treasurer’s Office.

Resources

Admin, C. (2022, December 1). City Government of Cagayan de Oro. https://cagayandeoro.gov.ph/index.php/news-and-article/item/1508-cagayan-de-oro-named-2022-galing-pook-awards-national-finalist.html

CDO bagged the best in Digital Finance Award at the 6th awards for excellence in ICT. About Cagayan de Oro. (2017, November 21). https://aboutcagayandeoro.com/cdo-bagged-best-digital-finance-award-6th-awards-excellence-ict/

Paunan, J. C. (2023, April 14). DICT Awards LGUs for excellence in digital governance. Philippine Information Agency. https://pia.gov.ph/news/2023/04/14/dict-awards-lgus-for-excellence-in-digital-governance